By Lawrence Williams

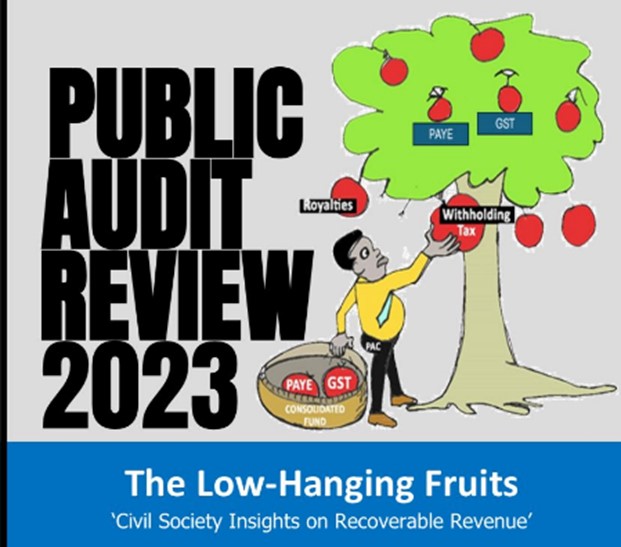

A Budget Advocacy Network (BAN) review of the 2023 Auditor General’s report has determined that revenue losses from domestic sources, including Pay-As-You-Earn (PAYE), Withholding Tax, and Goods and Services Tax (GST), severely impact service delivery in Sierra Leone.

According to BAN’s analysis report, total cash losses from these sources amounted to NLe65,035,959.08, with an additional $744,993.00 lost in royalty payments. PAYE accounted for the largest portion of these losses.

The report indicates that these funds, if recovered, could have a substantial impact on various sectors. For instance, the lost domestic revenue could fully fund the 2025 health sector budget, cover operational costs for the Sierra Leone Police and prison facilities, finance education expenses, and support social programs.

Cash losses from local councils in 2023 totaled NLe1,966,867.75, while state-owned enterprises reported losses of NLe55,820,267.20. These losses could have been used to fund grants, transportation subsidies, dietary provisions, and support various social and educational initiatives, the budget watchdog said.

BAN has recommended nationwide tax education campaigns, stricter penalties for tax evasion, prioritizing social impact sectors when allocating recovered revenues, and developing a framework for efficient utilization of funds.