By Lawrence Williams

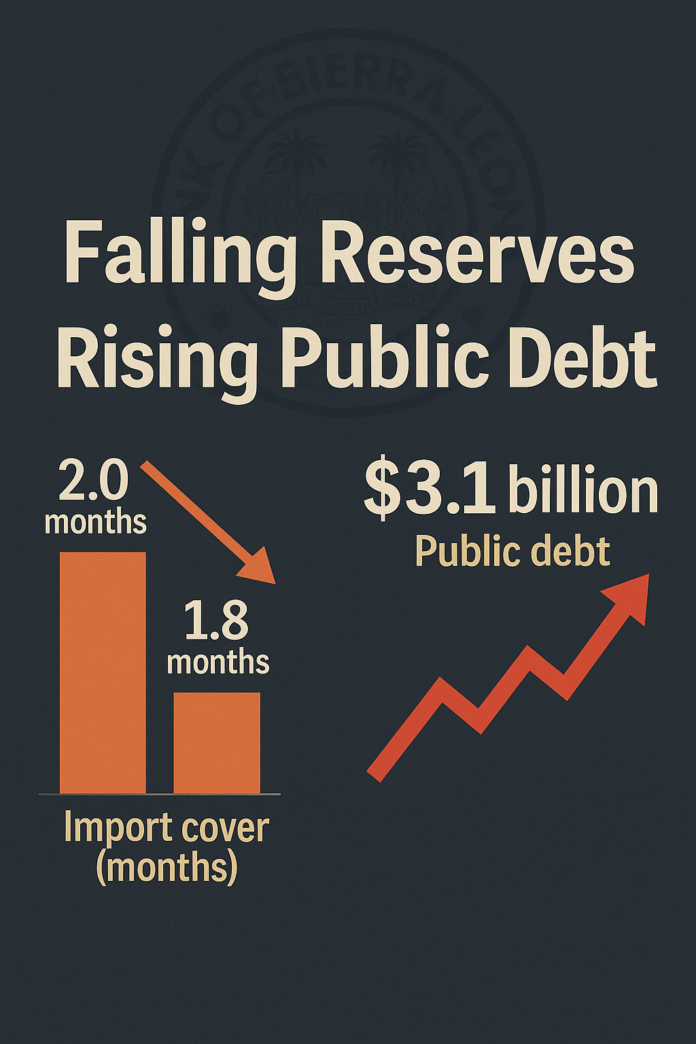

The country’s foreign reserves had fallen to just 1.8 months of import cover by the end of June 2025, down from 2.0 months a year earlier. Public debt also reached an alarming $3.1 billion by December of last year, comprising $1.8 billion in external debt and $1.3 billion in domestic debt, a significant increase from approximately $1.6 billion in June 2018, according to details of a supplementary budget presented to parliament on July 29.

Finance Minister Sheku Ahmed Fantamadi Bangura said the decline in foreign reserves was driven primarily by higher foreign currency outflows than inflows, with exports amounting to $424.1m whilst imports accounted for $537.8m in Q1 2025. Of these, minerals accounted for 75% ($317.9m) of export value whilst food and petroleum accounted for 63% ($340.9m) of import value during the same period.

“The level of reserve coverage is dangerously low for an import-dependent country like Sierra Leone,” said civil society activist Marcus Bangura. “It places added pressure on the Leone, risks inflation, and could destabilize monetary policy if urgent corrective measures are not taken.”

A 2024 joint IMF-World Bank assessment had raised an alarm about the country’s debt portfolio, stating it was at “high risk of debt distress.” Budget advocates feared that the high servicing costs associated with debt repayments could crowd out spending on essential services such as health, education, and infrastructure and are therefore pushing for debt restructuring and cancellation.

These figures highlight the government’s increased reliance on both external borrowing and domestic instruments such as treasury bills and bonds to plug fiscal deficits and finance key programs, Marcus Bangura added.

“We’re seeing a worrying trend of rising debt and falling reserves,” said a social commentator. “The government must focus on revenue mobilization, reducing leakages, and prioritizing expenditures if we are to maintain fiscal and monetary stability.”

The minister outlines plans for new financing and spending adjustments, but analysts say without structural reforms the country risks slipping further into economic fragility. He also highlighted plans to improve tax administration and increase efficiency in public spending, but budget deficits coupled with global headwinds could mean these measures may take time to bear fruit.

“The numbers speak for themselves,” one financial analyst told Fritong Post. “We’re in a tight spot. What matters now is how decisively and transparently government acts to restore macroeconomic stability.”