The World Bank has raised serious concerns about the country’s growing debt problems, warning that it still faces a very high risk of debt distress.

According to the latest World Bank Sierra Leone Economic Update (7th Edition, November 2025), the country’s debt challenges have worsened mainly because the government spent more than planned in recent years. These extra expenses forced the government to borrow more money at very high interest rates.

The cost of domestic borrowing, for instance, saw a sharp increase from 29.3% in 2023 to 40.8% in 2024. These high borrowing costs made it even harder for the government to manage its debt. Debt service, that is money used to pay interest and principal, was already very high, reaching 103% of government revenue, suggesting that a huge chunk of government revenue was used just to pay debts.

Although the cost of borrowing dropped sharply to 15.17% in May 2025 due to government’s efforts in reducing spending, the World Bank says the country is still in a dangerous position.

The report notes that Sierra Leone’s total public debt fell slightly from 46.2% of GDP in 2023 to 44.4% in 2024. This decline happened because the economy grew faster, the exchange rate was stable, and external debt reduced a little. But the improvement is not enough to reduce the overall risk.

In fact, total debt service in 2024 was estimated at 125% of government revenue, which is extremely high.

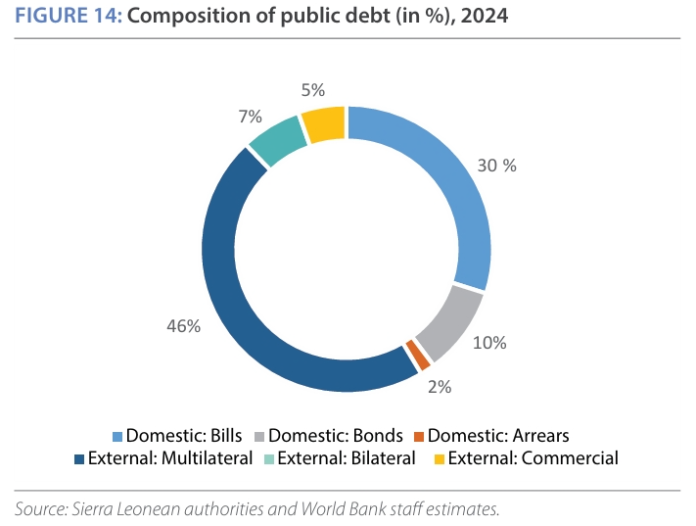

The nation’s debt profile reveals that external debt accounts for $1.8 billion, approximately 60% of the total debt. The majority of this external obligation is owed to multilateral creditors, with the IMF and World Bank alone comprising 30% of all of this portfolio. Additionally, the Kuwait Fund, South Korea, and China hold 12% of the external debt to bilateral creditors.

Domestic debt, which was 30% in 2021, has notably increased to 40% ($1.3 billion) by the close of 2024. The Bank reported that while most of this domestic debt consists of short-term treasury bills (T-bills), these instruments commanded extremely high interest rates, reaching a peak of over 30% in 2024.

The World Bank says that while the overall size of the debt is not the biggest issue, the cost of maintaining it is becoming a serious problem. Interest payments are rising fast, putting pressure on government finances.

The report warns that without stronger spending controls, better revenue collection, and more affordable borrowing, Sierra Leone’s debt situation could become even more difficult in the coming years.